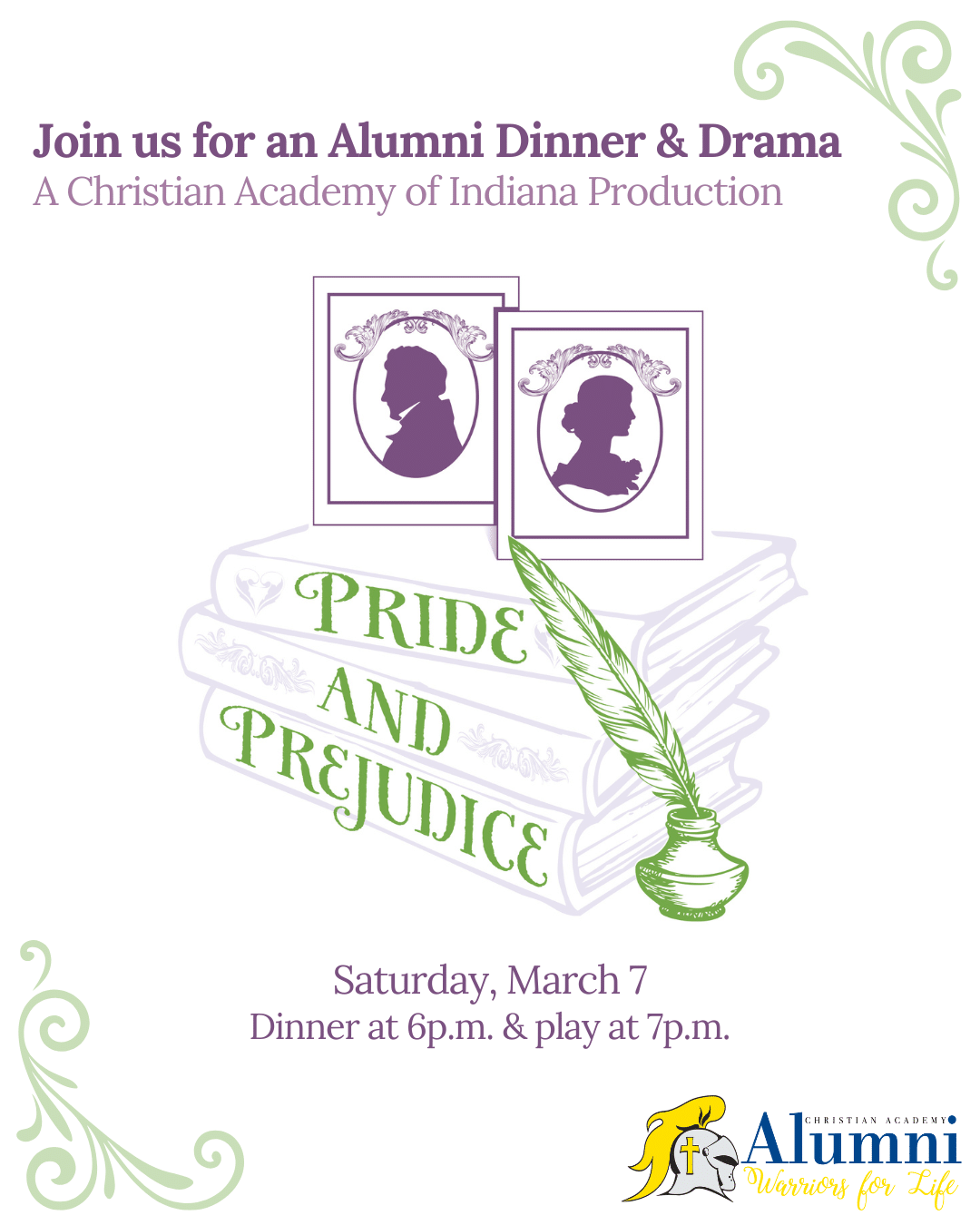

Warrior Alumni – Join Us for Dinner and Pride and Prejudice, March 7

Join us for dinner before the production of Pride and Prejudice on Saturday, March 7! Dinner from The Spaghetti Junction will be served at 6 p.m. in the Commons with the show to follow at 7 p.m.

Alumni and up to three guests will receive complimentary tickets to the production. Tickets are limited and a special alumni section will be reserved in the auditorium for those who pre-register. Please register here by Wednesday, March 4, to secure your seats.

Questions? Email Amy Koenig, Development Coordinator, at [email protected].

2026 Warrior Summer Sports Camp Registration is Now Open!

Looking for a summer full of fun, skill-building and team spirit? We’ve got you covered. From soccer to basketball, volleyball to archery and so much more – there’s a camp for every athlete at every level! Camps are open to the public so feel free to pass details along to any families you think might be interested by sharing this printable flyer or this post.

Registration is online here. A waiver must be on file for your child to participate. The deadline will be one week to the day prior to the start of each camp (for example, if Monday then the Monday before) so don’t wait!

Girls Volleyball (Incoming Grades K-4) – $110

Dates: July 13-17

Time: 10 a.m. – 12 p.m.

Boys Socer – $110

Dates: June 15-19

Time: 9-10:30 a.m. (Incoming Grades K-2)

Time: 10:30 a.m. – 12 p.m. (Incoming Grades 3-5)

Time: 12-1:30 p.m. (Incoming Grades 6-8)

Girls Soccer – $75

Dates: June 15-19

Time: 5:30-7 p.m. (Incoming Grades K-5)

Time: 7-8:30 p.m. (Incoming Grades 6-8)

Boys Baseball – $100

Dates: July 13-16

Time: 9-10:30 a.m. (Incoming Grades 1-3)

Time: 11 a.m. – 12:30 p.m. (Incoming Grades 4-6)

Co-ed Basketball – $110

Dates: July 6-10

Time: 12:30-2 p.m. (Incoming Grades K-2)

Time: 2-3:30 p.m. (Incoming Grades 3-5)

Girls Cheerleading (Incoming Grades K-5) – $110

Dates: July 20-24

Time: 9-10:30 a.m. (Monday – Thursday) and 6 p.m. (Friday)

Co-ed Archery – $100

Dates: July 27-30

Time: 5:30-7:30 p.m. (Beginner)

Time: 7-8:30 p.m. (Experienced)

Contact Kate Elliott, Assistant Athletic Director, at [email protected] with any questions.

CAI Alumni – Don’t Forget to RSVP for Homecoming!

Homecoming is almost here and we can’t wait to welcome you back to campus! Join us Friday, December 19, beginning at 6 p.m. as we kick off the evening with a complimentary dinner for you, our alumni, and your families.

NEW this Year: Every alumni in attendance will receive a free sweatshirt sponsored by Focus Eyecare Center! To guarantee your size, please RSVP here by November 25.

Come enjoy great food, laughter and memories as you reconnect with old friends, catch up with favorite teachers and celebrate the legacy of CAI together. It’s one of our favorite nights of the year-you won’t want to miss it!

The Time to Give Blood is Now! CAI is Hosting an American Red Cross Blood Drive, October 28

The Christian Academy of Indiana blood drive is less than one week away and we still need your help! All are welcome! Sign up HERE today to join us on Tuesday, October 28, from 11 a.m. – 5 p.m. in the CAI Commons.

If a CAI student or a parent donates, the student will receive a comfy day on Wednesday, October 29. Along with that, those who donate blood October 28, will also receive a $20 e-gift card to a place of their choosing and be entered to win a $5,000 prize three times! To receive this, you must supply a good email address for the Red Cross when registering.

Students 16 and older can donate, and if you are 16, your parents will need to fill out a consent form. You can turn them in to the front desk after filling it out. Students, please ensure that you have teacher permission if you sign up to donate during class.

If you have any additional questions, visit redcrossblood.org.

Please encourage your friends and family to donate so that this drive can be as successful as possible. Thank you for considering this opportunity!

Alumni – We Can’t Wait to See You at Homecoming 2025 on Friday, December 19

Join us as the Warriors take on South Central. Enjoy a complimentary dinner at 6 p.m. for you and your family along with admission to the night’s games.

Schedule is as follows:

4:30 p.m. Boys JV

6 p.m. Girls Varsity

7:30 p.m. Boys Varsity

NEW this year! We are excited to offer every alumni in attendance a sweatshirt! To guarantee your size, please RSVP Here by November 25.

CAI Alumni – Save the Date for Homecoming 2025!

Christian Academy of Indiana Alumni – We can’t wait to see you for Homecoming 2025 on Friday, December 19, as the Warriors take on South Central. Enjoy a complimentary dinner at 6 p.m. for you and your family along with admission to the night’s games.

Complete Details and RSVP Information, including a New this Year Opportunity, Coming Soon!

Christian Academy of Indiana Kicks Off the School Year with The Event

Ryan Miller for the News and Tribune

Families gathered Friday night at Sam Peden Community Park in New Albany for The Event.

NEW ALBANY – Going back to school can usually be one of a student’s least favorite parts of the year.

Having to navigate a new schedule, meeting new teachers, and waking up early all lead to students dreading late summer. However, when schools make an effort to welcome students back in a fun environment, it can lessen the blow a little.

Students, families and staff converse during Friday’s festivities.

Christian Academy of Indiana’s version of this event is, fittingly, The Event. The annual celebration sees students get ready for the new year at Sam Peden Park. The festivities include a meet and greet with teachers, a bake sale, and games of all kinds. Not only students find themselves looking forward to the event though. “It’s very exciting, I love seeing my former students and it does make me feel like we are a community not just a school,” said fifth grade teacher Shelly Abbott during Friday’s festivities.

These themes of community could be seen echoed throughout the entire event, with students of all grade levels laughing and chatting, parents saying hello to each other after a long summer, and teachers meeting their students for the next year. The students appreciate the fostered sense of togetherness as well.

“Yes, our schools are about community and specifically obviously Christian community because we’re a Christian school, so all the students coming out here and just being able to bond with their grade, playing games, bond with some upper classmen as well; I just think that it’s really important in building friendships and also mentor ships between us,” said senior Claire Trask.

The seniors are especially fond of this event, because all the money goes to the senior class trip. This being their last year, many students and even parents cannot help but feel a little emotional at one of their final CAI events.

“There’s no sweet to it, it is incredibly sad for me thinking that she might leave,” said Mallory Annis, a parent of a senior.

Christian Academy has been growing in enrollment, and is seeing a record high enrollment rate this year (1,258 students). With this amount of growth, many changes are being made to the school. One of these changes is a new building for the middle school, so the high school and junior high will no longer share a space. The two-story building will include 26 classrooms, a room for the choir, art rooms and labs. To add to the changes for middle schoolers in the coming year, CAI is welcoming a new middle school principal: Taylor Jarman. Jarman most recently worked as a principal for an elementary school in Texas, and has worked as a teacher/administrator for 12 years.

“I think one goal is to see all of our students grow and they desire to serve God and their academics and in their relationships and what we do as Christian Academy,” said Jarman. Jarman expressed excitement for this coming school year for myriad reasons, but he like many others are looking forward to the new building being completed. “I am most excited to see us continue to become a solid middle school because this is the first we’re starting a new building it’s going to be Hopefully finish later this year and so we’ll all be coming together for the first time fifth to eighth grade, as one middle school campus, that will be really cool to see,” Jarman said.

With CAI experiencing such a high number of students, it was heartening to the teachers to see such a big turnout to an extra-curricular event.

“It says that we’re all in this together,” said Abbott

CAI Alumni – You’re Invited to a Baseball Game, September 27

We’re excited to invite you to our Christian Academy Alumni Baseball Game on Saturday, September 27, at 11 a.m.! Whether you want to dust off your glove and step back onto the field or simply come out and cheer from the stands, we’d love to see you there.

Last year’s game was an absolute blast – full of laughter, friendly competition and plenty of great memories. This year promises to be just as fun and it’s the perfect opportunity to reconnect with old friends and teammates.

Please RSVP using this link so we can plan for players and spectators.

We can’t wait to see you out at the ballpark for a day of fellowship, fun and baseball!

Go Warriors!

Christian Academy of Indiana Alumni Inaugural Soccer Game, August 1

CAI Soccer Coach Neil Shaw would like to Welcome Back our CAI Alumni Soccer Players and Fans to Participate in an Alumni Soccer Game, August 1, 7:30 p.m. at a Location to Be Determined.

Contact Coach Shaw at (812) 302-2056 for More Information.

The CAI End of Year Armory Sale is Here!

We’re clearing out the store to make room for our Back-to-School gear — and that means BIG savings for you!

All clearance is 50% off and new markdowns storewide! Look for the blue dot to spot the best deals!

Now’s the perfect time to stock up on Warrior gear, gifts and more. Once it’s gone, it’s gone — so don’t wait!

Come shop, save big and help us make room for an even bigger Back-to-School sale!